For the past decade, Uber has always been about the network, providing a platform for riders and drivers to connect with a simple tap on their phone. The San Francisco-based ride-hailing company took the transportation industry by storm when it released its cutting edge ride-sharing app in 2009.

From offering services that include ordering your favorite foods through Uber Eats, peer-to-peer ride sharing, and renting electric bikes and scooters, the ride-hailing giant is now introducing a digital network of a different kind.

Moving beyond driving and delivering

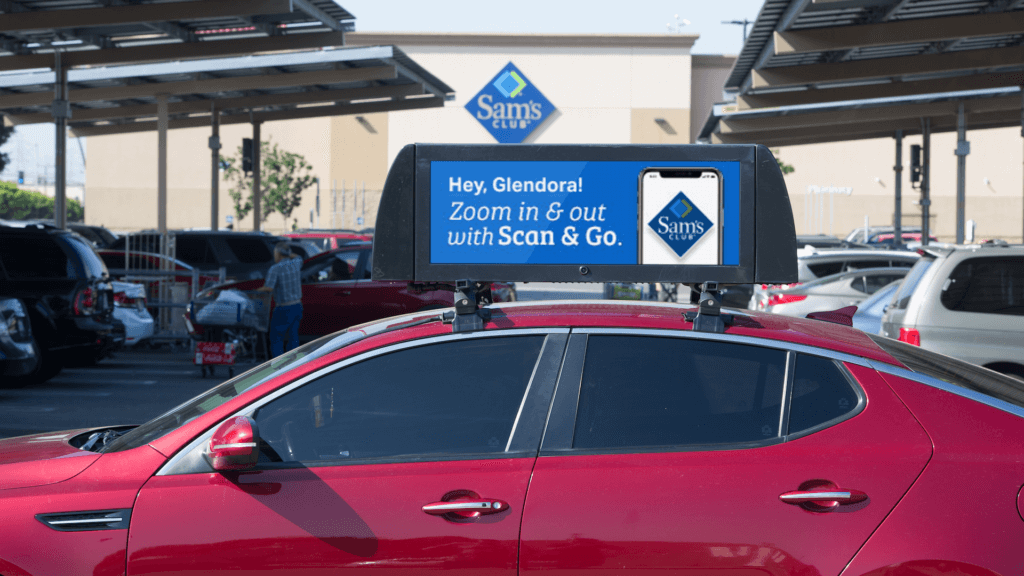

As of April 2020, Uber launched car-top digital billboards and began blasting ads at drivers and onlookers. The ride-sharing company has partnered with ad-tech company, Adomni, to create Uber OOH and launched digital screens for drivers in three cities: Atlanta, Dallas and Phoenix.

Even though independent contractors driving with Uber could previously install ad displays on their vehicles from third-party operators, this is the first time Uber has offered an ad platform of its own.

Collaborating with Adomni, Uber will sell the ad space by location and time of day and the units will feature two-sided, internet-connected screens on participating Uber drivers’ vehicles.

So what has compelled Uber to enter the advertising world? Let’s dive in to understand why the company has made this significant business move.

Top 5 reasons to enter the OOH market:

1. New revenue stream for Uber

Since going public in May 2019, Uber has struggled to generate revenue and become a profitable business. The company crushed the traditional taxi services by harnessing a low-paid workforce, but has never turned a profit and in the second quarter of 2019, Uber reported losing a whopping $5.2 billion.

This was Uber’s largest ever reported loss along with its slowest-ever revenue growth. These losses were mainly due to stock-based compensation and driver rewards, both stemming from the company’s initial public offering.

Thus, in today’s competitive market, where every dollar counts, a new revenue stream like the one presented by car-top advertising can significantly drive revenue and offset losses.

2. Extra revenue for drivers

The mobile advertising platform also provides an extra incentive for drivers. The deal allows drivers to generate revenue through digital advertisements displayed on screens atop of their cars.

The ad program pays drivers $300 to mount a digital screen about 4 feet long on a car’s roof-top. Drivers receive $100 for each week when they drive more than 20 hours to start, before the model shifts to paying them by the hour. This program also allows Uber to reward drivers whom it has to retain, without dipping into the company’s reserves.

3. Minimal cost for displaying ads

Another reason car-top advertising is beneficial to Uber is because of the very low cost. Uber has to provide an incentive to drivers for participating (and Adomni will take its cut), but otherwise, the cost of displaying ads on digital screens is minimal.

In addition, local businesses like car dealers and shops often pay hefty rates to advertise on billboards and other out-of-home spaces. These businesses can now save money by advertising through car-top ads while also bringing in an attractive ROI for Uber.

4. Targeting and reporting

Uber OOH ads also offer advertisers the flexibility to purchase ads on a programmatic basis and can change dynamically based on location and time of day.

Uber stated that it can geofence creative content “for the ideal audience,” which means it can show specific ads for places that are nearby. Adomni said in a release that advertisers will be able to display one ad on the car and a nearby billboard at the same time.

Thus advertisers can run ads only when and where their target audiences are likely to see them, which is significantly different from traditional OOH.

5. OOH is the only traditional medium that’s growing

Among traditional media, out-of-home (OOH) is the only channel that is growing, while all others, including TV and print, are phasing out. In fact, the US OOH advertising market was worth $10 billion in 2018, according to PWC.

The digital side is booming because changeable displays provide creativity and are more attractive. Digital OOH placements on car-tops can also change throughout the day as consumers travel from place to place.

As a result, digital OOH, especially programmatic, is rapidly growing and is likely to prove beneficial for Uber.

Final thoughts

With Uber losing 8.5 billion in 2019, breaking into the out-of-home (OOH) advertising market will provide an attractive return on investment and is an obvious appeal. This new advertising platform is a win-win situation and revenue generator for both Uber and its drivers.

Car top advertising on taxis has been around for decades, but now Uber is looking to capitalize on this existing trend in an effort to generate new revenue and reach profitability.